Exploration

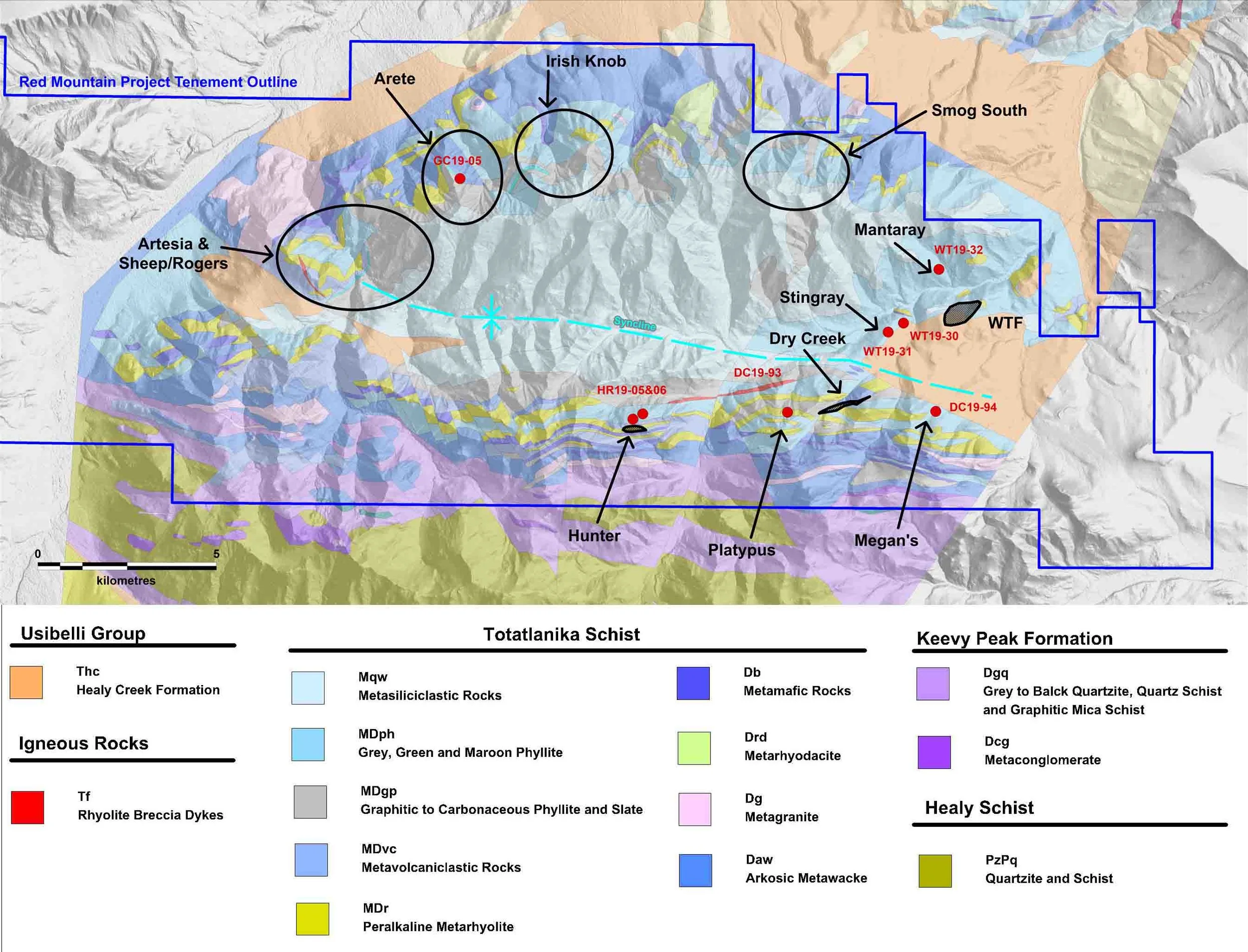

White Rock has chosen to focus exploration on the Bonnifield East area where the two most significant deposits of Dry Creek and West Tundra Flats are located on opposite limbs of a regional syncline (Figure 6). The syncline controls the distribution of the prospective VMS horizon with the upper metasiliciclastic rocks of the Totalanika Schist forming the hangingwall to VMS mineralisation throughout the district.

The prospective footwall sequence dips steeply to the north along the southern limb (where the Dry Creek deposit is located) and shallow to the south along the northern limb (where the West Tundra Flats deposit is located).

During 2016-17 White Rock compiled all available data sources of the Bonnifield East district, for use in defining VMS targets through the power of modern vector analysis and 3D processing. Targeting focused on specific extensions to the known mineralisation as well as district wide targets that could represent additional zinc – silver deposits in the Red Mountain VMS camp.

In 2016, Dr Jim Franklin, a recognised global VMS expert, completed an assessment of compiled surface geochemical data. The study aimed to use modern vector analysis to identify new exploration targets from old data. Dr Franklin was able to use the known deposits at Dry Creek and West Tundra Flats to calibrate his assessment of the regional data.

The resulting assessment prioritises the Dry Creek West, ReRun, West Tundra Flats, Smog and Glacier target areas as highly prospective for additional VMS deposits (Figure 6). Observations based on the zonation of geochemical alteration and detailed geological mapping provided by the Division of Geological and Geophysical Surveys (“DGGS”) suggest that each target area shows extensive lateral and vertical footwall alteration, and the potential for a number of mineralised horizons and indicators for proximal base metal (zinc-lead) and precious metal (gold-silver) mineralisation.

Figure 6 Red Mountain high priority conductors (pink) on a conductivity depth slice at 40m below surface from the 1D inversion of airborne electromagnetics. Locations for the Dry Creek and West Tundra Flats VMS deposits, and target areas (ReRun, Dry Creek West, Rod, WTF, Smog South, Smog North, Glacier East, Glacier West and Sheep Rogers) are defined by geochemical alteration (in green boxes), and the corridor of conductors along the northeast trend from Dry Creek to West Tundra Flats (dashed yellow line).

Condor Consulting, Inc., recognised experts in the field of airborne electromagnetics (“EM”), completed a detailed interpretation of the EM and magnetics survey flown by the Alaskan DGGS in 2007. Condor was able to use the known deposits at Dry Creek and West Tundra Flats to calibrate the assessment of the EM and magnetics data. A number of high priority conductors were identified as having the potential of being caused by massive sulphide mineralisation (Figure 6). The highest priority conductors are located within the identified geochemical target areas, some of which are coincident with strong base metal and precious metal anomalies from historic sampling (Conductors 1 to 30).

Subsequently, White Rock expanded the Red Mountain tenement package to 143km², which covered the best geochemical targets along both limbs of the syncline (Figure 6), including a significant area down-dip of the exposed prospective VMS horizon. The expanded tenement position provided White Rock with a significant land package containing numerous targets with the potential for additional deposits that could transform the Red Mountain project into Alaska’s next development project.

White Rock launched an exploration program at Red Mountain in 2018, the results of which led to the Company more than tripling the size of the project’s tenement package to an area of 475km² (Figure 7).

The exploration program also resulted in the signing of a cornerstone investment and strategic relationship agreement with Sandfire Resources (ASX: SFR), which has since evolved into an earn-in and joint venture agreement with the established miner.

The Red Mountain Project now comprises 894 State of Alaska Mining Claims and Mineral Locations.

The data compilation and validation in 2017 enabled White Rock to deliver a maiden Mineral Resource estimate for the Dry Creek and West Tundra Flats deposits.

During 2018 White Rock completed its first field season of on-ground exploration with a number of successful milestones in advancing the project towards proving up that the Bonnifield Mining District can indeed be an emerging new VMS camp of significance, containing zinc, silver, lead and gold.

Highlights of the 2018 field season that extended from late May to early September included:

A total of 24 drill holes for 4,111 metres of diamond core drilling.

Best drill intersection in the history of this project into the Discovery Lens at the Dry Creek deposit with 4.7m @ 19.5% Zn, 7.8% Pb, 466g/t Ag, 6.9g/t Au and 1.5% Cu for 49.7% ZnEq¹ (DC18-79)².

Down dip extension of the Fosters Lens at the Dry Creek deposit with 4.3m @ 4.8% Zn, 2.3% Pb, 1,435g/t Ag, 2.2g/t Au and 0.5% Cu for 43.2% ZnEq¹ (DC18-77)² and remaining open down dip.

Best drill intersection in the history of this project at the West Tundra Flats deposit with 3.5m @ 15.1% Zn, 6.7% Pb, 518g/t Ag, 2.1g/t Au and 0.2% Cu for 35.2% ZnEq¹ (WT18-28)³.

Discovery and successful drill testing of the new Hunter prospect massive sulphide mineralisation with 1.4m @ 17.4% Zn, 3.9% Pb, 90g/t Ag & 1.6% Cu for 25.8% ZnEq¹ from 48.2m (HR18-01)⁴. This discovery remains open east and west and down dip with massive sulphide mapped for over 500 metres along strike on the surface.

Identification of 9 high priority geochemical anomalies⁵ from a detailed regional stream sediment program across the core area of regional prospectivity centred on the Bonnifield East syncline with particular emphasis on two distinct anomaly clusters; west of the known mineralisation at Dry Creek (the southern limb of the Bonnifield syncline) and in the Glacier Creek area with strong sulphide footwall alteration on the northern limb of the Bonnifield syncline. Strong base metal anomalism up to 1.1% zinc in streams indicates high prospectivity for outcropping massive sulphides.

Successful orientation ground geophysics across known mineralisation with CSAMT accurately identifying massive sulphide mineralisation at Dry Creek and West Tundra Flats enabling the technique to be a rapid reconnaissance tool for identifying drill targets within zones of anomalous geochemistry and favourable stratigraphy⁶. The CSAMT crew acquired 40 line km of new data along strike of Dry Creek and West Tundra Flats.

Successful application of portable XRF analysis of soil samples to deliver rapid target generation.

Expansion of the tenement package⁷ with an area of 475km² now secured over the Bonnifield Mining District and additional prospective footwall stratigraphy, plus a number of additional historic VMS mineral occurrences at Anderson Mountain, Virginia Creek, Cirque, West Fork, Peaches, Keevy Peak, Kenny, Sheep Creek and Surprise Creek, not yet explored with modern techniques.

The successful progress of the 2018 exploration program resulted in the signing of a cornerstone investment and strategic relationship agreement with Sandfire Resources NL (ASX:SFR) (Sandfire) that subsequently resulted in Sandfire signing an Earn-In and Joint Venture Agreement⁸ (JVA) regarding the Red Mountain Project. Sandfire contributed $2.5 million equity and a further $1 million convertible loan unsecured to White Rock during 2018.

Stage One of the JVA will see Sandfire fund A$20M in exploration on the project over the first four years to earn 51%. Sandfire can then elect to increase its interest to 70% by sole-funding a further A$10,000,000 and by delivering a pre-feasibility study with an Ore Reserve.

White Rock were appointed manager for 2019 with an initial A$6,000,000 exploration budget approved for the 2019 field season. Subsequently during the field season a further A$2,000,000 was committed by Sandfire to extend the exploration programme into September with 4,000 metres of diamond drilling planned to test new targets in the expanded A$8,000,000 exploration programme. The 2019 field exploration program developed in conjunction with Sandfire aims to drill test the maximum number of new targets possible within the Company’s strategic 475km² belt-scale regional tenement package.

2019 field season activities commenced and/or completed include:

A 3,000 line kilometre SkyTEM airborne electromagnetics (AEM) survey covering 500km² The new SkyTEM survey was the first modern high-powered time domain EM survey at Red Mountain with the capability of identifying conductivity anomalies to depths of 300m. The survey also included the collection of magnetics data.

Satellite spectral analysis including the assessment of hyperspectral data to identify and map alteration zonation.

Regional whole rock lithogeochemical analysis of tenement-wide rock chip samples collected in 2018 and accessed from the Alaskan Geologic Survey to identify regional alteration zonation and assist in prioritising targets for detailed field exploration and drill testing.

Detailed on-ground geological reconnaissance and soil geochemical sampling across regional target areas using a portable XRF analyser to deliver rapid target definition;

Detailed electrical ground geophysics (CSAMT and MT) across the regional targets replicating the most rapid field acquisition electrical technique that successfully mapped conductivity associated with mineralisation at both of the two existing deposits: Dry Creek and West Tundra Flats;

A diamond drill program to test the best of the regional targets. These high-priority targets are defined by this multidisciplinary use of airborne EM, the 2018 stream geochemical anomalies that were identified5, new satellite defined alteration, whole rock lithogeochemical alteration, on ground soil & rock geochemistry and on ground electrical geophysics; and

Selective down hole electromagnetics surveys to identify off-hole conductivity anomalies for follow-up drill testing.

Sandfire withdrew from the JV in early 2020 due to other competing capital funding and their recent acquisition of MOD Resources in Botswana.

¹ Zinc equivalent grades are estimated using long-term broker consensus estimates compiled by RFC Ambrian as at 20 March 2017, adjusted for recoveries derived from historical metallurgical testing work and calculated with the formula:

ZnEq =100 x [(Zn% x 2,206.7 x 0.9) + (Pb% x 1,922 x 0.75) + (Cu% x 6274 x 0.70) + (Ag g/t x (19.68/31.1035) x 0.70) + (Au g/t x (1,227/31.1035) x 0.80)] / (2,206.7 x 0.9). White Rock is of the opinion that all elements included in the metal equivalent calculation have reasonable potential to be recovered and sold.

² Refer ASX Announcement 4th July 2018 “High Grade Zinc-Silver Drill Intersections Extend Mineralisation at Red Mountain”.

³ Refer ASX Announcement 18th June 2018 “Initial Drilling Delivers High Grade Zinc Results at Red Mountain”.

⁴ Refer ASX Announcement 20th August 2018 “High Grade Zinc Discovery at the Hunter Prospect, Red Mountain”.

⁵ Refer ASX Announcement 4th December 2018 “New Geochemical Anomalies Associated with VMS Alteration, Red Mountain”.

⁶ Refer ASX Announcement 20th June 2018 “New Massive Sulphide Mineralisation Drill Intercepts Coincident with Geophysics Anomalies at Red Mountain”.

⁷ Refer ASX Announcement 21st November 2018 “Expanded Land Holding with Additional High-Grade VMS Prospects, Red Mountain”.

⁸ Refer ASX Announcement 25th March 2019 “Joint Venture Agreement signed with Sandfire Resources”.

Figure 7: Red Mountain Project tenement outline on terrain map with locations for the Dry Creek and West Tundra Flats VMS deposit Mineral Resources, the new discovery at the Hunter Prospect and outlier VMS prospects.

Figure 8: Conductivity depth slice of the 1D inversion model of the SkyTEM electromagnetics data at 120m below surface. The survey highlights conductivity features associated with VMS mineralisation at the Dry Creek and West Tundra Flats (WTF) deposits.

Figure 9: Location of 2019 drilling activities including upcoming targets along the Glacier Trend, on the DGGS geology map (after Freeman et al., 2016) and terrain surface with locations for the Dry Creek and West Tundra Flats (WTF) VMS deposits.

White Rock considers Red Mountain to be one of the highest-grade and more significant deposits of any zinc company listed on the ASX.

Alaska is ranked 5th out of 83 mining jurisdictions by the Fraser Institute.

The project is well situated within the following infrastructure and logistics:

Major road and rail access located 120km west, and 85km north

All weather road and rail connection to the port of Anchorage 400km south

Access to fresh water

No community or environmental legacy issues

Established mining hub at Fairbanks; services mines including Pogo, Fort Knox and Usibelli